Know the Difference: Payment Gateway vs. Payment Processor

February 21, 2020

It seems like you can order almost anything online these days, so it is important to understand exactly how the process works. Nearly all businesses today will interact through eCommerce at some point. As a merchant, you want to offer customers a secure and easy to use payment method while also keeping your costs low.

You may have heard the terms “payment gateway”, “payment processor”, “virtual terminals”, and “shopping cart”. But what is the difference between them? And why does it matter? Well, these are all distinct services that can make various impacts on your business.

Terminology

We know the payment world is complicated, so it is important to be clear on some of the commonly used terms.

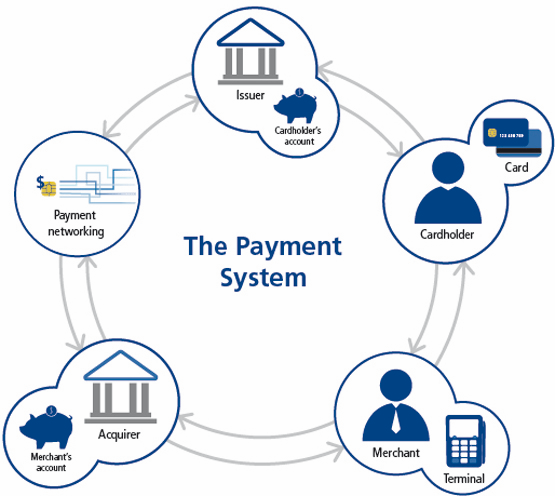

Merchant: That’s you! A merchant offers a product or service that can be purchased.

Customer: Cardholder. Someone who wants to purchase your product or service. When shopping online, the customer is able to complete the transaction without the merchant’s involvement.

Issuing Bank: The bank that issued the customer’s credit card.

Merchant Account: This is the term for your bank account.

Acquiring Bank: The bank that hosts your credit card processing account (processor).

Tokenization: Encryption of information being sent to the issuing bank.

In-Person Transactions

What is a Payment Processor?

You can think of the payment processor as the manager of the transaction. They manage the communication between the merchant, issuing bank, and an acquiring bank.

How does it work?

For in-person card payments, the payment processor provides the merchant with a payment terminal.

The payment terminal authenticates the card before sending information to the issuing bank to approve or decline the transaction.

The payment processor sends the approval or denial message to the physical terminal and sends approved transactions to the acquiring bank.

Online Transactions

What is a Payment Gateway?

Payment Gateways are used for eCommerce or transactions where a card is not present. You can think of a payment gateway as your terminal for online transactions.

How does it work?

The payment gateway decodes the data for the issuing bank and encrypts it again to send the response to the payment processor.

At this point, the payment processor finishes the process in the same manner as in-person payments.

Why does it matter?

Since a physical card is not shown to the merchant, the payment gateway is crucial for authenticating the payment. The gateway must protect customer’s information by encrypting the data transferred to the issuing bank (tokenization). Customers expect this to happen quickly since online shopping is supposed to be efficient and they want their transactions to complete quickly.

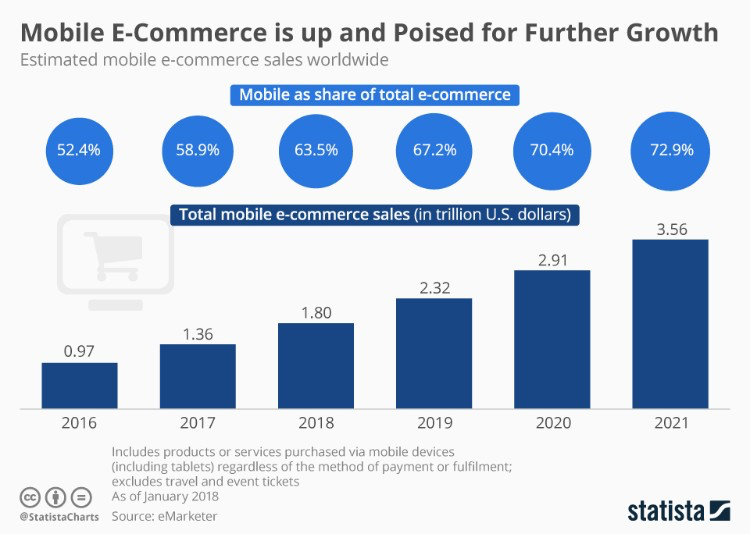

Sales in online retail nearly doubled between 2014 and 2018 to a whopping $2,489 trillion (USD)! It is no wonder that so many businesses want to join the world of eCommerce. More and more people are online shopping, especially since companies like Amazon have sped up delivery times and ease of purchase. Customers appreciate the efficiency of online shopping, so merchants must provide a quick and easy payment process to help keep things moving.

Merchants not only need to be able to take a payment on their website but should also give customers the ability to make purchases on their smartphones. It is important to note that not all e-commerce payment companies will have this capability, so it is crucial to work with the right one to make sure you don’t miss out on business from mobile websites.

What to Do:

In both card-present and online transactions, the acquiring bank is in charge of authentication. Whereas, the physical or virtual terminal is relied on to encrypt the card’s information. It is extremely important to choose a trustworthy and reliable physical or virtual terminal. We work with our trusted payment partners to ensure your business can benefit from eCommerce while keeping transactions safe.

How to do it:

Of course, there are numerous payment gateways available and it is hard to know which to choose. That’s why you should leave it to the Payment Experts to find the perfect payment solution for your unique business! We have extensive experience with online processing and work with great companies like Bambora, Authorize.net, and Clover.

Get in touch with The Payment Experts today to schedule a free consultation! We will work hard to find you an affordable and reliable payment solution that both you and your customers will love.