Find Your Credit Card Processing Rate

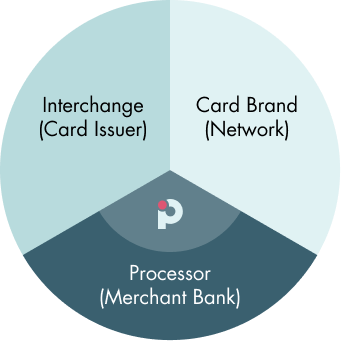

The credit card industry is complex by nature and that is why you advocate a

completely transparent “interchange plus” pricing model.

What is interchange?

Interchange is the rate that your customers issuing bank (the bank that they received their credit card from) charges for depositing the funds from a purchase to your bank account. The interchange rate incentivizes the financial institutions to participate in this ecosystem and also pays for the benefits that consumers have come to expect, such as protection against fraud, car rental insurance, perks like travel rewards for spending more and the ability to pay their credit card bill after they have actually made purchases every month.

Interchange Rates

Vary By The Card Type

Interchange rates vary by the type of card your customer is using and whether or not the transaction is taken in person (“Chip & Pin”) or not. For example, Visa has the following different interchange rates for consumer cards in Canada. Examples of ‘Card Not Present’ transactions would be Online Payments (either through a Virtual Terminal or a Payment Gateway integrated directly into your shopping cart) or transactions taken over the phone.

| Card Type | Card Present | Card Not Present |

|---|---|---|

| Classic, Gold, Platinum | 1.25% | 1.40% |

| Infinite | 1.57% | 1.65% |

| Visa Infinite Privillege | 2.08% | 2.40% |

*Visa rates As of April 2024

The card brands also charge an assessment fee that is added to every single transaction, regardless of card type.

Payments Experts adds one simple fee on top of the interchange rate & assessment fee. Please beware that many company’s entire strategy is to sign merchants up to a low rate at the beginning and raise rates slowly over time.

Other Processors will tell you that they are offering you a “Qualified Rate” or some other form of teaser pricing, but beware, as there is no way to avoid these interchange rates.

Look out for any of the folllowing fees on your statement

- Differential Fees

- Network Access Fees

- Return Fees

- Non-Qualified Fees

- Network Maintenance Fees

- New Fees We Have Never Heard Of!

If you would like to discuss how to remove them

To learn more about your rights as a merchant,

read more about the Code of Conduct here.Whether you decide to work with Payment Experts or not, we strive to provide more transparency and increase the overall image of our industry, so we hope that you will choose a provider that is completely transparent and will work for you, not against you.

With Payment Experts we will not only provide a higher level of service, but we will also strive to provide better equipment and technology like the Clover Flex and Pax Terminals at a lower overall cost to your current provider.