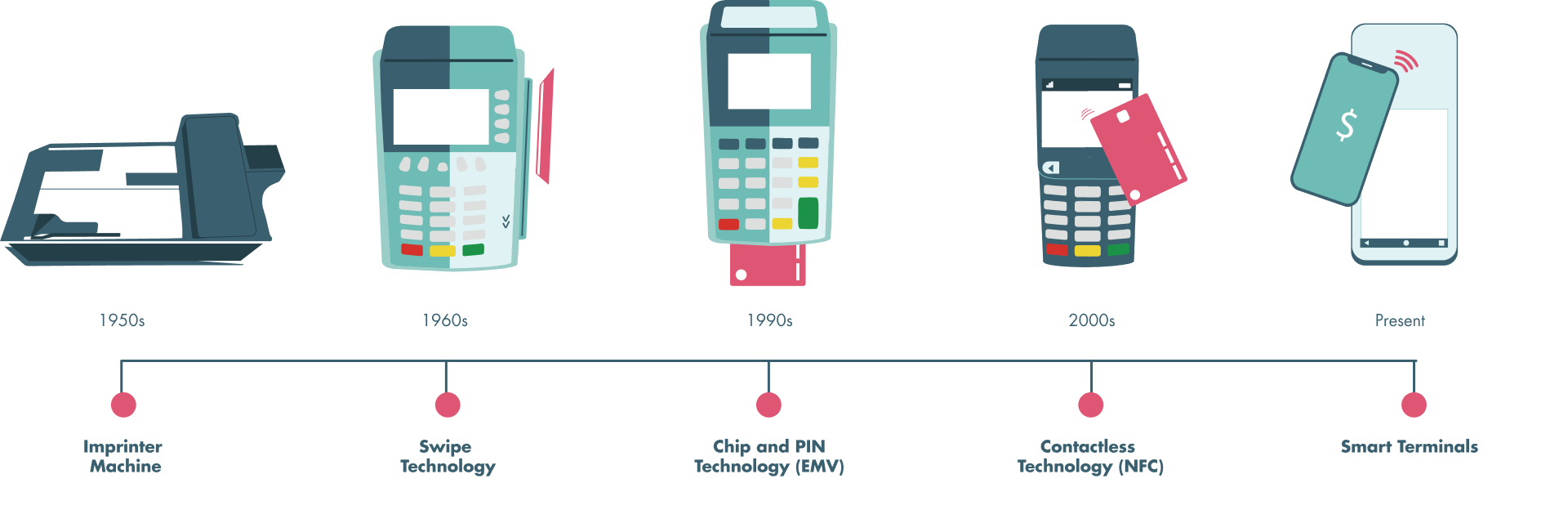

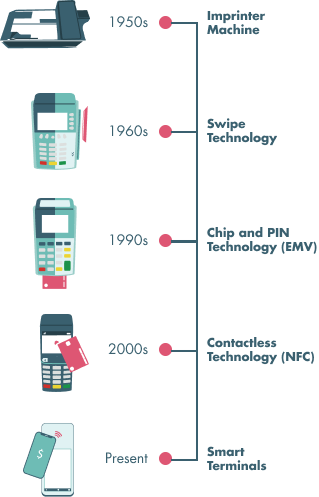

Evolution of Electronic Payments

Back in the 1950s, the way payments were taken was revolutionized with the invention of the credit card. The Diner’s Club card started the cashless revolution when a person was given the ability to pay their bill with nothing but a cardboard card and a signature. Fast-forward to the 21st century and a merchant can accept payment using a debit card or credit card from virtually anywhere using a Poynt or Clover Flex smart terminal. In fact, we no longer even need the card to be present, as the advent of Apple/Android Pay has moved the card to our Smartphones. Almost every industry is seeing increased competition from either E-Commerce giants like Amazon or Big-Box retailers like Wal-Mart, and in order to keep up with the times Merchants are realizing that they need to provide the most convenient customer experience possible, all the way from the service/product itself to the payment method offered at checkout. This includes offering Online Payment Solutions and the newest Android Terminals such as the Clover Flex and Poynt.

Evolution of Smart Terminals

Why accept Electronic Payments in the First Place?

While most of our customers have already taken the leap to accepting electronic payments, a large percentage of the Business-to-Business world has never accepted Credit Cards before, and given the general trend towards more credit card acceptance, these merchant need to weigh the benefits vs. the costs:

1) Credibility

1) Credibility

There is a massive amount of consumer trust that has been placed in the Credit Card brands. Consumers trust these companies with their cash and as a result, they trust merchants that accept their cards.

2) Increased Sales

2) Increased Sales

Credit Cards offer 2 main advantages to your customers, they provide rewards for every dollar spent and give your customers access to more time to pay their bills. Given that many people no longer carry cash, this both broadens your potential customers as well as allows them to spend more at your establishment and buy things on impulse without having to worry about paying for it right away.

3) Improve Cash Flow and Decrease Theft

3) Improve Cash Flow and Decrease Theft

Cash still needs to be deposited in your bank account and is the easiest form of money to be stolen. Credit card payments are often deposited into your account the next business day without having to waste your most valuable asset (your time) by driving to the bank depositing checks or cash.

When you decide either it is time to start enjoying the benefits of electronic payments for the first time, or you simply want to save money and upgrade to better technology and service, contact us at Payment Experts.

What We Offer (homepage)

1 on 1 dedicated support

Next & Same Day deposits

Real-time reporting

Chargeback support

No surprise fees

24/7 support

Setup assistance

Easy integration

Fraud prevention tools